8 (951) 793-95-18

8 (908) 043-53-42

Ежедневно с 10 до 23How do you calculate the gross profit margin percentage? Profit Analytics Community

Мы всегда стараемся публиковать для вас интересные статьи, касающиеся таких тем как: татуировки, татуаж, заживление тату, модные тенденции, история тату и прочее. Если тебе интересно, оставайся с нами!

Contents:

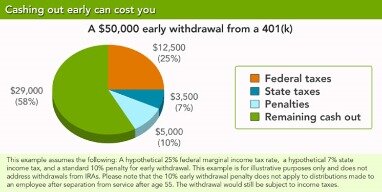

Sometimes, even though the GPMP is low, the company’s overall profitability may remain high because of unusually high sales volume. Gross margin is the result of subtracting the cost of goods sold from net sales. Gross margin may also be expressed as a percentage, which is often used when comparing businesses of different sizes and different industries. Companies want high gross margins, as it means that they are retaining more capital per sales dollar. If you are like many business owners, you don’t have an accounting or business background.

- But then, in an effort to make up for its loss in gross margin, XYZ counters by doubling its product price, as a method of bolstering revenue.

- It’s easy to overlook minor inefficiencies as long as margins are high, but a drop in gross margin could signal a decline in productivity.

- It is essential to increase the gross margin ratio, since it is a key driver of the net profits generated by a business.

- A company’s real profits can only be calculated once all costs are subtracted.

- For example, analysts are looking at a manufacturing company and professional services groups for potential investment.

Using the numbers from the manufacturing example, the gross margin calculation shows a gross margin of $200,000. For example, if a company has generated $10 million in revenue with $3 million in COGS, the gross profit is $7 million. From reporting, accounting, and financial consultation to contracting a CFO for your business, CFO Hub can guide you through all of your pecuniary puzzles. With actionable insight from a dedicated team of experts, we can place all the pieces properly and master your margins together. Contribution margins represent the revenue that contributes to your profits after your company reaches its break-even point . Some retailers use markups because it is easier to calculate a sales price from a cost.

Finally, gross profit margin does not indicate how much of a company’s profit is generated from its core business. A company that earns a large amount of profit from its investments or other non-core businesses may have a low gross profit margin. Second, gross profit margin does not take into account changes in sales volume.

Profit margins tell you how much a company makes from selling goods and services after covering direct and indirect costs. Profit margins are percentages that measure profitability — higher percentages mean higher profits. Calculating profit margins is a core aspect of many accounting roles and careers in finance. For example, investment bankers use profit margins to determine if a company is profitable and worth the investment. Understanding how to calculate profit margins can also help certain accountants, like certified management accountants, build budgets because they can see what areas are causing the most loss in profits.

Everything You Need To Master Financial Modeling

The Gross Margin Ratio, also known as the gross profit margin ratio, is a profitability ratio that compares the gross margin of a company to its revenue. It shows how much profit a company makes after paying off its Cost of Goods Sold . To determine the operating profit margin, we need to divide the operating income or operating profit by the company’s total revenue and then multiply by 100. Operating profit is useful to know because you can use it to compare companies in states that may have different tax rates.

For example,retail stores want to have a 50% gross margin to cover costs of distribution plus return on investment. Each entity involved in the process of getting a product to the shelves doubles the price, leading retailers to the 50% gross margin to cover expenses. You can calculate profit margins backward to determine how much to charge for a single product or how much revenue you’ll need to make to offset your expenses. Understanding how to calculate profit margins is a core responsibility of accountants and many other finance professionals.

First, let us break down the example into the variables that are required in our formula. However, she may be able to improve efficiencies and perhaps realize higher profits. Lately, she has been thinking of expanding her line of clothing, too. Generally Accepted Accounting PrincipleGAAP are standardized guidelines for accounting and financial reporting. Accrual Method Of AccountingAccrual Accounting is an accounting method that instantly records revenues & expenditures after a transaction occurs, irrespective of when the payment is received or made. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

How to Know if a Company Is a Worthwhile Investment

A good long-term option is to redesign products so that they use less expensive parts or are less expensive to manufacture. The concept of target costing can be used to develop products that are designed to have specific margins. If a targeted margin cannot be achieved, then a product is not manufactured. When looking at your gross margin, benchmarking against averages in your industry gives you a more accurate picture of how you stack up relative to competitors. She might produce a small batch of the new clothing and see how those items sell.

There is a decrease in the selling price of the goods without a corresponding reduction in the cost of goods sold. Similarly, there is a decrease in the cost of goods sold without a corresponding reduction in the selling price. Let us now move on to the significance and implications of the gross profit ratio. This is most likely when there are few other competitors from which customers can buy, and especially when supplies are tight.

The Gross Margin Ratio in Different Industries

Marking up goods will also lead to higher gross margin since there will be higher net sales. However, increasing the price of goods should be done competitively otherwise, the cost of the goods will be too expensive. Cost of goods does not include administrative costs or other overheads like rent and utilities. Net sales is total gross sales minus discounts, promos, and returns.

Public Works Software Market Emerging Offers New Opportunities … — Digital Journal

Public Works Software Market Emerging Offers New Opportunities ….

Posted: Fri, 21 Apr 2023 09:19:09 GMT [source]

To find the net profit margin, you divide the net income by total revenue, creating a ratio. Gross profit margin is the percentage left as gross profit after subtracting the cost of revenue from the revenue. In some industries, like clothing for example, profit margins are expected to be near the 40% mark, as the goods need to be bought from suppliers at a certain rate before they are resold. In other industries such as software product development the gross profit margin can be higher than 80% in many cases. Companies might also use the gross margin ratio to compare their current and previous performances.

The Relationship Between Gross Profit Margin and Net Profit Margin

The gross profit margin percentage gives you valuable information about your business. Overall, the GPMP is a good indicator of the company’s financial health. Its simplicity makes it an easy metric for comparing your business to your competitors’ (assuming their GPMP’s are known). If your GPMP is better than your competitors’, it confirms that you’re operating the business with better than average efficiency. If your GPMP is less than your competitors’, it’s a warning that your pricing, sales and/or manufacturing adjustments need to be made.

With a selling price of $100 and a cost of $75, the $25 markup as a percentage of the $75 cost is 33.33% ($25/$75). The gross profit of $25 ($100 — $75) also means a gross margin of 25% ($25 gross profit divided by the selling price of $100). Since you know the cost of a product and you know the gross margin percentage to be achieved, you can determine the selling price and the markup needed.

Platform as a Service Market Size and Growth: Regional Insights … — Digital Journal

Platform as a Service Market Size and Growth: Regional Insights ….

Posted: Fri, 21 Apr 2023 09:19:09 GMT [source]

Profit margins are an easy way to determine if a company is profitable and can inform investing decisions and help with crafting budgets. The operating margin represents the proportion of revenue which remains after variable costs are subtracted. Sometimes referred to as return on sales, operating margin equals the operating income divided by net sales. From the explanation, the gross profit is calculated by subtracting the total cost of production of goods from the net sales.

Both massachusetts state income tax profit and gross margin are key metrics business owners should continually review to remain profitable. So, it turns out to be one of the primary factors to be checked when a better player from the same industry needs to be picked. As in the case of all profitability metrics, the gross margin should be used in conjunction with other metrics to fully understand the cost structure and business model of the company.

What Is a Profit Margin?

Once all expenses are added up, there may be a mere $0.05 left as profit. This would mean that the company’s profit margin ratio is only 5%. All Other ExpensesOther expenses comprise all the non-operating costs incurred for the supporting business operations. Such payments like rent, insurance and taxes have no direct connection with the mainstream business activities. Net SalesNet sales is the revenue earned by a company from the sale of its goods or services, and it is calculated by deducting returns, allowances, and other discounts from the company’s gross sales.

INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Would derive by adding all the purchases, direct cost , opening inventory, and subtracting the closing inventory. Companies within a given market accept «standard» margins rather than explore pricing options. Gross margin is one of the most important and simplest measures of a business’s efficiency. Since COGS were already taken into account, the remaining funds are available to be used to pay operating expenses , interest expenses, and taxes.

Global Lithium-Ion Capacitors Market [2023-2030] Discover the … — Digital Journal

Global Lithium-Ion Capacitors Market [2023-2030] Discover the ….

Posted: Fri, 21 Apr 2023 08:48:48 GMT [source]

The gross margin amount indicates how much money a company has to invest in growing the business. If most of the gross profit is used to cover administrative expenses and operating costs, little money is available to enable growth. A lack of capital is one of the primary reasons that small businesses fail. If income statements are available on a monthly or quarterly basis, compare the gross margin figures. If margins are rising, that may be an indicator of improved efficiencies. It can also indicate that lowering prices to increase sales is having a negative impact on financial stability.

Gross margin ratio is aprofitability ratiothat compares the gross margin of a business to the net sales. This ratio measures how profitable a company sells its inventory or merchandise. In other words, the gross profit ratio is essentially the percentage markup on merchandise from its cost.

This means that industries, where the cost of production is low, will have a higher gross margin ratio, while those where the cost of production is higher will have a lower gross margin ratio. Gross margin ratio is one of the most effective ways to evaluate the financial performance of a business. This measure reflects productivity in terms of how a company uses its raw materials, labor, and other factors of production. Gross margin ratio takes into consideration the cost of sold goods alone. This is because its primary purpose is measuring the profits from selling products or services.

Calculating gross margin allows a company’s management to better understand its profitability in a general sense. But it does not account for important financial considerations like administration and personnel costs, which are included in the operating margin calculation. Gross Profit RatioThe gross profit ratio evaluates the proportion of the direct profit a company generates from its net sales.

Assume Jack’s Clothing Store spent $100,000 on inventory for the year. Unfortunately, $50,000 of the sales were returned by customers and refunded. The gross profit margin shows the amount of profit made before deducting selling, general, and administrative costs, which is the firm’s net profit margin. The profit margin is critical to afree-market economydriven bycapitalism. The margin must be high enough when compared with similar businesses to attract investors.

Gross profit is calculated by subtracting the cost of goods sold from net sales. The GPM is used to measure how efficiently a company is able to turn its sales into profits. A company with a high gross margin ratios mean that the company will have more money to pay operating expenses like salaries, utilities, and rent. Since this ratio measures the profits from selling inventory, it also measures the percentage of sales that can be used to help fund other parts of the business.Hereis another great explanation. The gross profit margin ratioanalysis is an indicator of a company’s financial health.

Gross profit is your income or sales less cost of goods sold , which are all fixed costs . Contribution margin analyzes sales less variable costs, such as commissions, supplies, and other back office expenses . Gross margin ratio is an economic term that refers to the ratio between a company’s gross profit to net sales. It is a ratio that gives insight into how much profit is made per unit product. The gross margin is mostly expressed as a percentage and is calculated by dividing the gross profit of a company by its net sales or revenue.