8 (951) 793-95-18

8 (908) 043-53-42

Ежедневно с 10 до 23Forex Trading Online FX Markets & Currencies FOREX com Europe

Мы всегда стараемся публиковать для вас интересные статьи, касающиеся таких тем как: татуировки, татуаж, заживление тату, модные тенденции, история тату и прочее. Если тебе интересно, оставайся с нами!

Contents:

Access TradingView charts with over 80 indicators, Reuters news feeds, behavioural science technology and much more. The immediate action tends to be unpredictable as scalpers (traders who look for constant opportunities to lock in multiple short-term trades) enter the fray in a fastest-finger-first race. Conversely, a high number of additional jobs is likely to be a positive factor in terms of pushing USD gains. A particularly positive forecast ahead of an NFP release can have the same effect as would NFP data which radically outperforms estimates. Extended trading is conducted by electronic exchanges either before or after regular trading hours.

Since the EUR/USD is themost actively tradedcurrency pair in the world, it usually has the smallest spread and the most price movement for making trades. During the NFP statement, there is no need to trade another pair. Volatile Week Ahead As Risk Events EyedThe next few days could be wild and incredibly volatile for financial markets thanks to key central banks meetings, a semi-annual Congress appearance … One approach is to wait and see how the markets react when the news comes out. Since market moves can be volatile, there could often be an initial knee-jerk reaction when the data is first released.

Join our expert analysts as they explain what NFP is and how you can find trading opportunities. During the NFP, you can place trades of any amount on any instrument. If you do happen to lose your trade, you can receive compensation up to $2,500. Simply contact our support team within 24 hours after your position has been settled with your trading number. We’ll provide you your “Trading Credit” within two business days, equal to the amount of loss of the position you specified. The NFP is a highly volatile event and presents a great opportunity for traders to profit.

How Can NFP Release Affect the USD? — Action Forex

How Can NFP Release Affect the USD?.

Posted: Fri, 10 Mar 2023 08:00:00 GMT [source]

ForexSignals.com helps traders of all levels learn how to trade the financial markets. The Non-Farm Payroll report, or NFP, is one of the most important Forex events each month and a key economic indicator for the US economy. Our Forex economic calendar will show you the key global events that will impact the financial markets.

A lower employment picture is negative for the world’s largest economy and thegreenback. If the NFP report shows a decline below 100,000 jobs or less, the U.S. economy is likely stagnant and forex traders will favor higher-yielding currencies against the U.S. dollar. Some traders take a position in the markets around the NFP release as the data has historically been known to cause sudden price movements in the market, giving rise to potential trading opportunities. This is because the higher the number of people in employment in a country, the better its economic output can be expected to be at the end of the quarter and vice versa. The non farm payroll trading strategy is suitable in the situation where the market travels in atight range before the news is released. As many experienced traders have learned, the NFP report is notoriously difficult to trade successfully.

Imports become more expensive as more GBP is required to buy 1 USD. HowToTrade.com helps traders of all levels learn how to trade the financial markets. NFP affects not just the US economy but also economies around the world that do business with the US. It also impacts traders, investors, and businesses that are affected by changes in the employment and economic outlook. NFP is an economic indicator that measures the net change in the number of employed people in the United States, excluding the farming industry, government employees, and non-profit organizations. Since the NFP data is a predictor of American employment, the data release has the greatest impact on currency pairs, including the U.S.

Experienced traders to help you make sense of the Forex market

By registering you accept Customer Agreement conditions and Privacy policy and accept all risks inherent with trading operations on the world financial markets. Trading during NFP is highly recommended because of its’ vast financial potential. It affects greatly the exchange rate of the US dollar and two favorite trading pairs – GBP/USD and EUR/USD. NFP data is more straightforward and objective than other sources of economic data. Forex traders face indicator after indicator when it comes to investing effectively; it’s sometimes an information overload.

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-vQW4Fia8IM73qAYt.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

This includes EUR/USD, GBP/USD, USD/CAD, and USD/JPY, to name a few. Your stop-loss should be placed just above the high of the previous bar, i.e. the high of the initial NFP candle. From FBS analysts to learn more about the current trading news events and how they will affect your Forex trading. This article is about the nature of one of the most potent fundamental indicators, Nonfarm payrolls.

US Departament of Labor

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Call IG USA FX or email to talk about opening a trading account. Simply join our Trading Room, follow the instructions, and watch our NFP live streams for your chance to win.

Every month on the first Friday, the U.S.Bureau of Labor Statisticspublishes data on new job growth in the United States, as well as other labor market data. All paying jobs are included in the data, with the exception of government employees, private families, non-profit organizations, and the farming industry. While volatility in the markets around the non-farm payrolls announcement is an opportunity for traders to try and profit, it can also result in a losing trade very quickly. It’s therefore very important to pay attention to your risk management approach. The Non Farm Payroll News Forex Trading Strategy is acurrency news trading strategy you can use to trade the Non farm payroll data. Fundamentals is a big part of trading, and Sentiment is built on market trends.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

Then wait for news to get released and it will activate one of the pending orders. Whatever pending order that is not activated has to closed immediately. This candlestick pattern was the signal to get into the trade; an entry near the close of the candle (around 1.2890) with a tight stop below the low (near 1.2875) would have given a low 15 pips of risk. As we can see, the pair eventually rallied all the way up to 1.2950, over 60 pips above the entry signal. We have a shorted but exciting trading week and month ahead with NFP,FED Chair PowellandGovernor Carneyspeaking as well as several interest rate decisions across the varying central banks. NFP (Non-Farm Payrolls) is data released by the Bureau of Labor Statistics every year.

What Is The Difference Between Trading And Investing?

The headline number represents the number of added https://g-markets.net/ over a month, excluding farm jobs, government jobs, employees of NGOs, and private household employees. The Non Farm Payrolls or NFP fundamental economic indicator released in the United States has a well deserved reputation as being one of the most focused on pieces of information used by forex traders. The NFP report is arguably the most important fundamental data point for the US economy. So while interest rates changes also have a big impact on forex, it is important to note that they change as a result of the NFP report. Effectively, interest rates are lagging indicators of what is going on in the economy.

When the NFP shows strong employment growth, it indicates a growing economy. It can increase investor confidence, leading to higher demand for the currency of the country that released the report. This increase in demand can cause the currency to appreciate against other currencies, leading to stronger exchange rates. Conversely, a lower-than-expected NFP number signals that the US labour market struggles and that the Fed could cut interest rates to support the economy.

Past performance in the markets is not a reliable indicator of future performance. The headline number shows the number of added jobs to the US economy during the previous month, excluding farm employees, private household employees, and government jobs. To take the most advantage of the report, traders also need to follow the details of the report, including the average hourly earnings and the monthly unemployment rate. The level of non-farm employment change, also known as the non-farm payrolls or the NFP is one of the most high-valued indicators in the economic calendar.

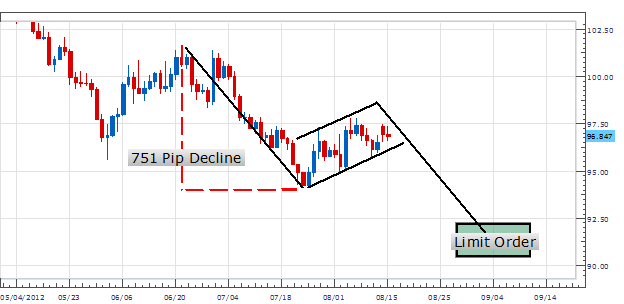

Below is the chart for the simple NFP strategy from the June 3 announcement. Below is the March 4, 2022 Simple NFP Day Trading example on a 15-minute chart. The trade did not hit either the 2x or 3x profit targets. Because of the large stop loss, a trailing stop loss would have worked better here. It managed to get to the 2x target but not the 3x target before the 4-hour time limit for the trade. Keep the stop loss to 20 pips or less, or below the high/low of the inside bar, whichever is smaller.

International politics, for example, can play large roles in certain government’s employment. Same goes for widespread crises, such as a virus epidemic or natural disasters. The data is then placed alongside the unemployment rate, which is based on a household survey of employment.

If the nfp forex trading provides two entry signals and both are losers, likely the price action is choppy and/or not suited to the strategy that day. It’s up to each to each of us to define how we want to trade. Maybe you will only trade Trend Continuations and only on a certain time frame at a certain time of day. Using primarily TC trades, this day produced 8R (8% if risking 1% per trade) in profit within 1 hour of the news release. It provides ample trading opportunities most days , and because the stop loss is relatively small it’s possible to capture multiple 2R or 3R trades throughout the day.

For instance, let’s assume the payrolls have exceeded expectations and are therefore expected to boost the value of the US dollar against a basket of other major currencies including the pound. Instead, the GBP/USD exchange rate rallies as soon as the announcement comes out, and the pound initially moves sharply higher against the dollar. It is intended to represent the total number of paid workers in the US, with the exception of farm, government and private-household employees, plus employees of non-profit organisations. The non-farm payrolls are typically released an hour before the official opening of the US stock market, on the first Friday of each month, although the date will occasionally vary due to a public holiday. Though a reversal is not inevitable , even catching a reversal 33% of the time can lead to a profit if the trader utilizes a strong risk-to-reward ratio.

When employment is high and in a good state, policymakers create an expansionary monetary policy with low-interest rates. Once again, a trader will study what is happening in the world and try to find the most similar example of the current events in the past. In most cases, the market tends to repeat its own patterns and the information from previous scenarios can give us a very good idea of how things might play out. It represents a summary of data that plays a key role in the US economy. As partially obvious from the name, NFP includes information on various employment related factors in every field except for farming.